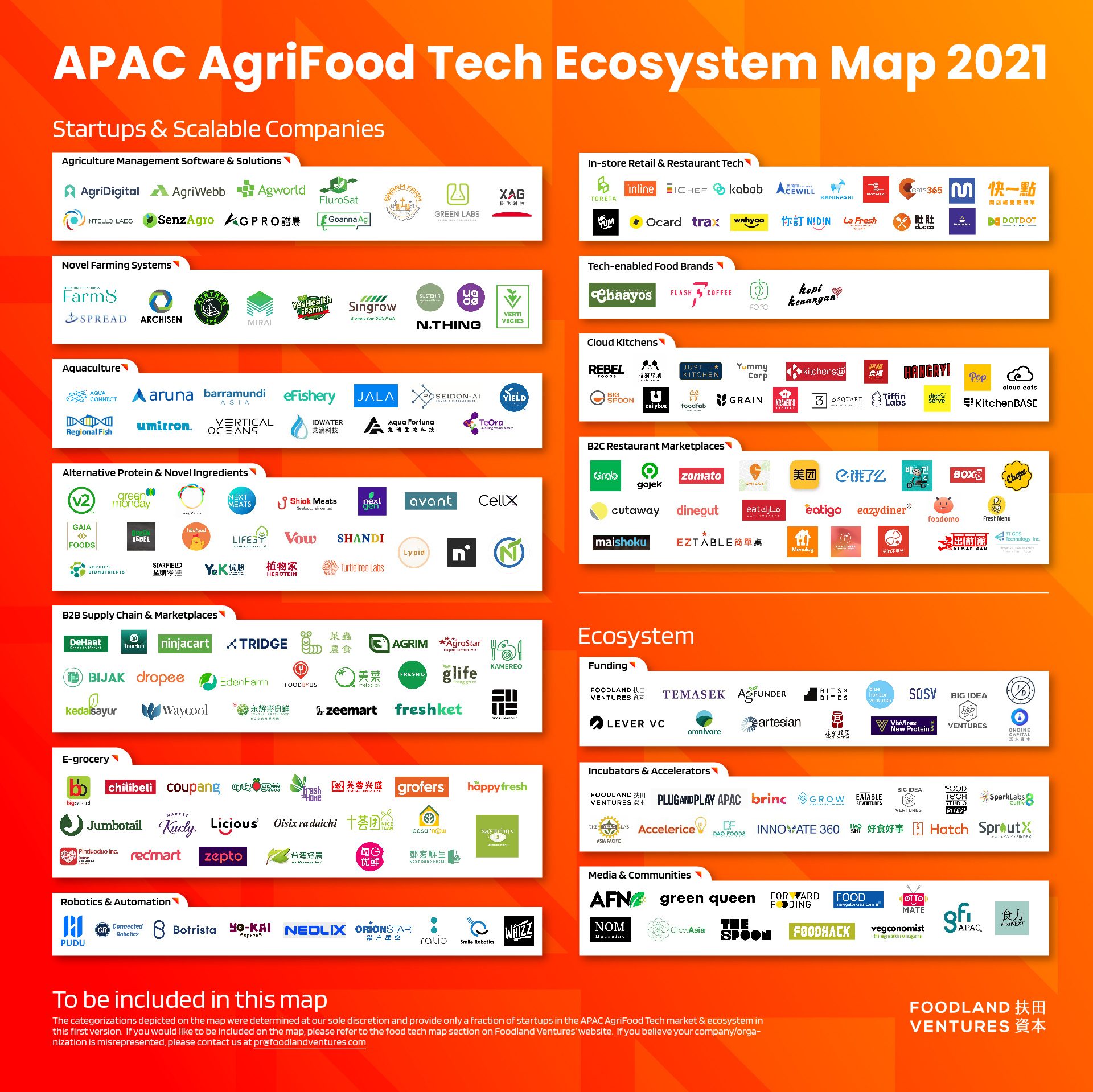

APAC AgriFood Tech Ecosystem Map 2021: Meet the 200+ Startups & Corporates Reinventing the F&B Industry

Foodland Ventures is publishing the APAC AgriFood Tech Ecosystem Map 2021 ahead of the APAC Food & Beverage Innovation Summit 2021 on Nov 25th, 2021 (register here to attend.). The Map features 200+ innovative companies from 14 categories across the entire AgriFood value chain, and identifies trends reshaping the sector.

For years, innovation and F&B brands have been relatively fragmented and funding for Asia Pacific’s AgriFood tech sector has lagged behind that of the US and Europe. But this won’t be true for much longer.

With a rising and hungry middle class in Asia, the region’s importance for the global food supply chain is growing fast. In the first half of 2021, China, India, and Singapore saw over $7 billion invested into AgriFood tech. And a large wave of AgriFood Tech innovators is emerging to disrupt the sector.

Who are these innovators? And what trends are they sparking? The team at Foodland Ventures, the food tech VC & Accelerator, selected 200+ innovative companies as an overall review for its inaugural APAC AgriFood Tech Ecosystem Map. These innovators come from across the entire value chain from farm and food production to consumer-facing solutions. And many of them will come together at the Summit on Nov 25th.

Digitalization as a Response to Consumer Demands in Traceability and Supply Chain Security

Covid-19 has left its mark on the global food supply chain. Demands for better traceability, supply chain efficiency, and food security are also rising. In response, the AgriFood supply chain is digitizing, and funding is pouring in.

In Supply Chain & Agribusiness Marketplace, notable deals include India’s DeHaat closing its $115 million series D round in Q4 of 2021, and Ninjacart, also based in India, crossed $500 million in valuation in Q2 of 2021, while Tanihub from Indonesia closing its $66 million series B round in Q22 2021. Other notable players in this space include Kamereo from Vietnam and Tsaitung Agriculture from Taiwan.

Digitization is also happening in the B2C sector of E-grocery across Asian countries, including a $65 million series D raised by Indonesia's HappyFresh, and the recent $60 million from India’s Zepto in its first-ever institutional funding round. Meanwhile in China, with its huge market and highly-digitized consumer base, e-grocers still play a defining role in the B2C sector, including Pinduoduo (NASDAQ:PDD) and Xingsheng Youxuan’s $3 billion funding round backed by Sequoia and Tencent.

APAC Emerges as Leader in Cloud Kitchens

APAC emerged as the leading region in the Cloud Kitchen market with the largest market share in 2020, and a number of key innovators in the region have made their mark: India-based Rebel Foods became a unicorn in October after a $175 million fund raise took its valuation to $1.4 billion. Taiwan-based Just Kitchen (TSXV: JK) became one of the first cloud kitchen groups to go public in North America in April. There are also newcomers such as Indonesia-based Yummy Corp and Hangry, Philippines-based CloudEats, Taiwan-based 3 SQUARE, and Malaysia-based Pop Meals (formerly DahMakan), growing rapidly as aggregator platforms and restaurants ramp up their cloud kitchen business.

Not Just Platforms and Apps, Tech-enabled Food Brands Surging

Digitalization is not just fueling marketplaces, platforms and e-grocers. More and more beverage retailers are leveraging a tech-enabled grab & go strategy to improve customer experience, proactively drive growth and significantly increase operational efficiency. This phenomenon can be seen in the rise of Tech-enabled Food Brands as startups in this space have continued to attract capital from investors. Indonesia-based Kopi Kenangan, for instance, received backing from Sequoia India that brought its total disclosed funding to $137 million. Other existing players in APAC include Singapore-based Flash Coffee backed by Rocket Internet, India-based Chai tea cafe chain Chaayos backed by Tiger Global, and Indonesia-based Fore Coffee backed by East Ventures.

Alt-Protein is on the Rise, with Singapore Leading in APAC

Apart from the immense impact Covid is leaving in the food supply chain, rising awareness of social issues like sustainability and wellness is fueling growth in the alt-protein sector in Asia. With some of the most meat-intensive diets in the world and a fast-growing middle class, alt-protein brands in APAC are nonetheless seeing high growth and catching up with their American and European counterparts. Well-funded startups in the space include v2food from Australia ($135 million Series B round), Green Monday in Hong Kong ($70 million Series A round), China-based Starfield ($25 million Seed round), Next Gen Foods ($32 million Seed round) and Shiok Meats ($20.4 million Series A round) in Singapore, where the high dependency on imported food products has also been an accelerating factor for the alt-protein sector. With the first approval of commercialized cultivated meat in the world, Singapore has established its role as APAC’s leader in this space.

Agriculture is Getting a new Face in Asia too

Food production security has not only contributed to the alt-protein sector, but also the rise of Novel Farming Systems in certain Asian countries, especially in Singapore and Korea where traditional farming practices are limited by the size or conditions of land. APAC players in this space consist of companies building facilities with advanced technologies such as vertical and indoor farming. Notable companies include Farm8 which is eyeing IPO in 2022 and N.THING Inc. ($26 million Series B) from South Korea, as well as Singapore-based Sustenir Agriculture.

Assembling Innovators Across the Region to Push the Ecosystem Forward

To assemble and highlight innovations happening across the region, Foodland Ventures is hosting the APAC Food & Beverage Innovation Summit 2021 on Nov 25th, with 7 panel discussions, 30 startup showcases, and 1-1 networking opportunities with investors & startups. Topics include alternative-protein, vertical farming, supply chain innovations, in-store restaurant tech, e-grocery, and cloud kitchens, with founders and executives from Impossible Foods, Focus Brands, Oisix ra daichi, Unfold, Shiok Meats, Just Kitchen, Kamereo, Yummy Corp, Botrista Technology, and more. You can watch the video playback here!

*To be included in this map:

The categorizations depicted on the map were determined at our sole discretion and provide only a fraction of startups in the APAC AgriFood Tech market & ecosystem in this first version. If you would like to be included on the map, please refer to this form. If you believe your company/organization is misrepresented, please contact us at pr@foodlandventures.com